Get a head start in finance with “Equity and Fixed Income Level 1 2010 Vol 5,” a pre-owned paperback from Pearson Custom Publishing. Perfect for those starting their journey in investment management or preparing for Level 1 exams, this book offers a solid introduction to core concepts of equity and fixed-income markets. This volume provides a snapshot of market dynamics and financial instruments from 2010, offering timeless principles applicable even as markets evolve. Inside, you’ll discover valuable insights into company analysis, financial statement interpretation using ratios, and understanding the role of dividends. The book also covers market efficiency. On the fixed-income side, you’ll explore bond valuation, interest rate risk measurement, bond indentures, features, and the significance of credit ratings. **Please Note:** This is a used copy exhibiting signs of previous study, including highlighting and writing. This may aid in understanding key concepts. Online access codes or supplements are not guaranteed to be included or functional. Despite these imperfections, this book remains a cost-effective resource to gain fundamental knowledge in the world of finance.

Equity And Fixed Income Level 1 2010 Vol 5

13,11 $

In stock

Description

Slight shelf and edge wear. If applicable, online access, codes or supplements are not d to be included or work. There are writing/highlighting marks in the book.

Dive deep into the world of finance with "Equity And Fixed Income Level 1 2010 Vol 5," a comprehensive guide published by Pearson Custom Publishing. This paperback edition, designed for Level 1 study, offers a robust foundation in understanding equity and fixed-income securities, crucial for anyone pursuing a career in investment management or financial analysis. While this is a pre-owned copy, it presents a valuable opportunity to acquire this essential learning resource at a more accessible price. Please note that this particular copy shows signs of previous use, including slight shelf and edge wear, which is typical for a used textbook. Importantly, there are writing and highlighting marks within the book, indicating previous student engagement with the material. While these annotations may be helpful in identifying key concepts and areas of focus, they also represent a characteristic of its used condition. Unfortunately, any supplementary online access codes or materials, if originally included, are *not* guaranteed to be functional or present with this copy. This volume from 2010 provides insight into the market dynamics and financial instruments as understood at that time. While markets have evolved, the fundamental principles of equity and fixed-income valuation remain consistent, making this book a valuable resource for understanding core concepts. This understanding is invaluable even as markets evolve and change. Equity investments cover a broad range of topics. The text dives into company analysis and financial statements. Also how to use ratios to evaluate profitability, liquidity, and solvency. Equity sections explain the important role of dividends in the total return of a stock. In addition, the book covers market efficiency. The fixed-income portion explains types of bonds and their valuation. It dives into how to measure the interest rate risk. Also understand bond indentures, features, and the importance of credit ratings. Though pre-owned and showing some wear, this volume provides a cost-effective way to access the vital knowledge needed to understand the basics of finance.

Additional information

| Binding | |

|---|---|

| Condition | |

| ISBN-10 | 0558160212 |

| ISBN-13 | 9780558160210 |

| Language | |

| Publisher | |

| Year published | |

| Weight | 1429 |

SKU: G-9780558160210-4

Category: All books

Related products

-

Cajun Justice

15,51 $ -

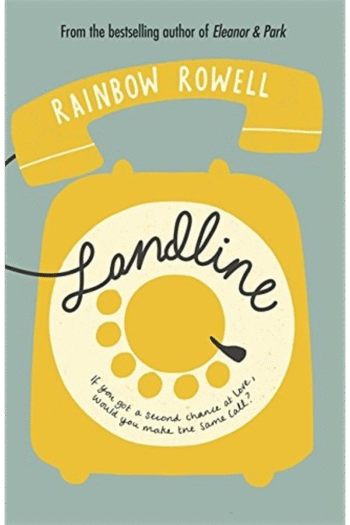

Landline

13,84 $

- Additional information

- Currencies

- USD – United States dollar

- EUR – Euro

- GBP – Pound sterling

- CNY – Chinese yuan

- BRL – Brazilian real

- MXN – Mexican peso

- JPY – Japanese yen

- PHP – Philippine peso

- THB – Thai baht

- PLN – Polish złoty

- CAD – Canadian dollar

- MYR – Malaysian ringgit

- AUD – Australian dollar

- TWD – New Taiwan dollar

- CZK – Czech koruna

- SEK – Swedish krona

- HUF – Hungarian forint

- ILS – Israeli new shekel

- CHF – Swiss franc

- HKD – Hong Kong dollar

- DKK – Danish krone

- SGD – Singapore dollar

- NOK – Norwegian krone

- NZD – New Zealand dollar